Estimate your appraisal mileage in minutes

As an appraiser, you drive a lot. You also understand that keeping track of all your vehicle costs is important — especially at tax time. But tallying incomplete handwritten mileage logs, and guesstimating is not the way to do it.

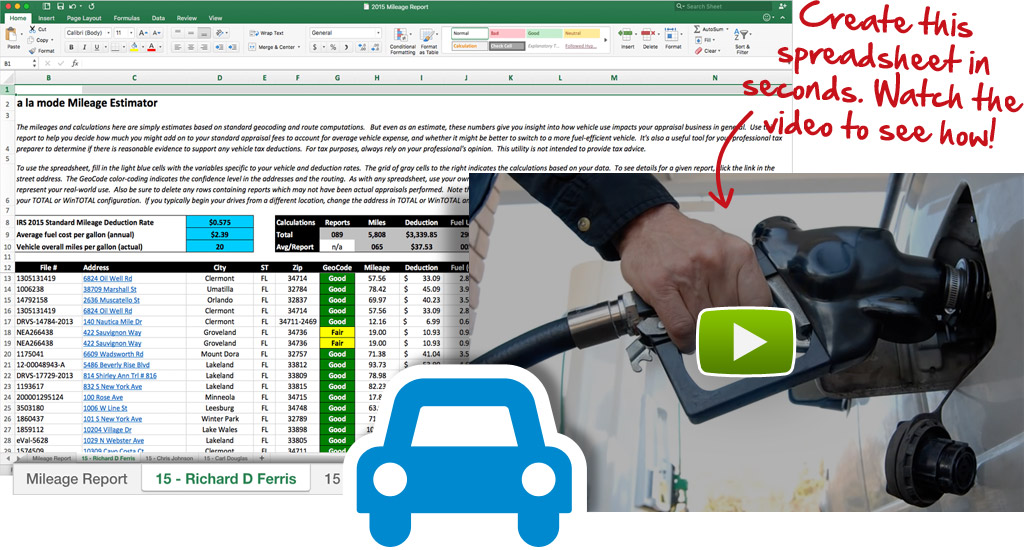

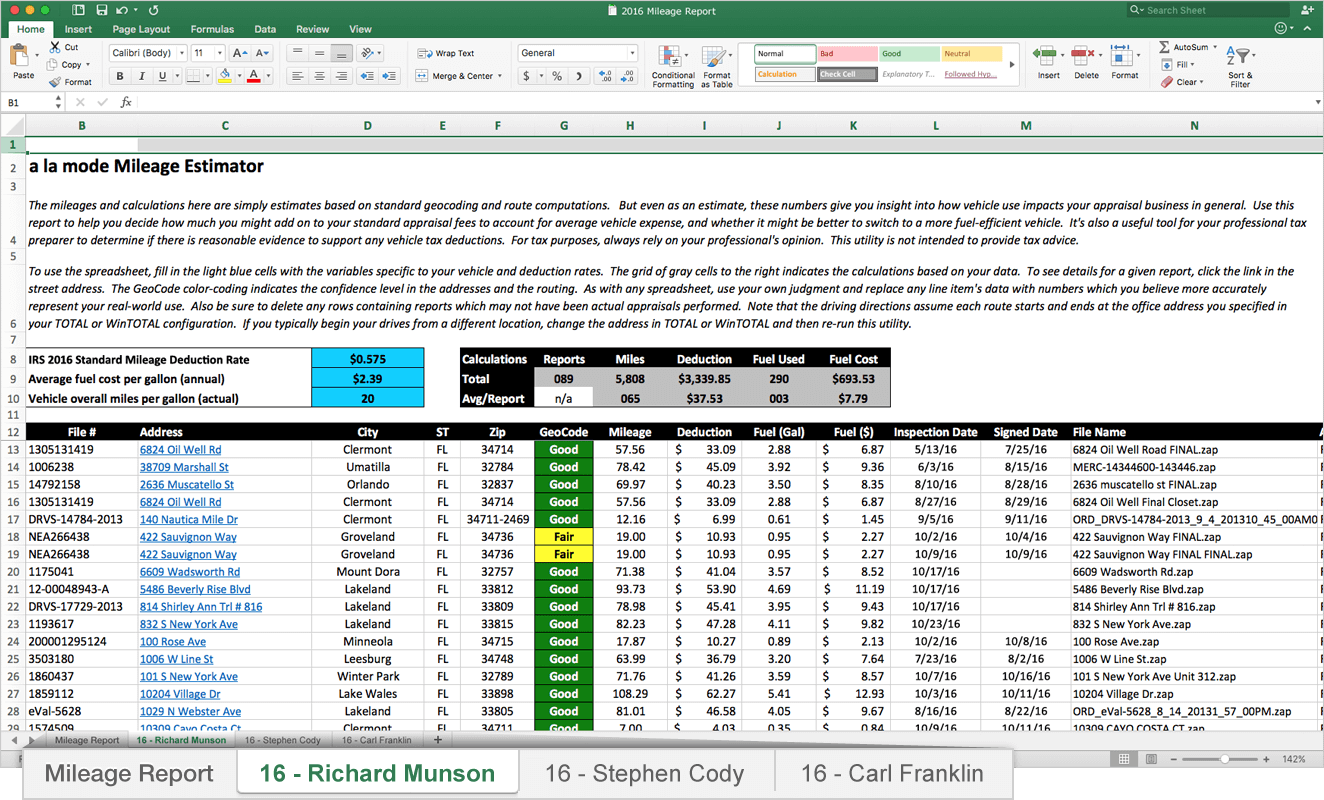

With Mileage Estimator, you can turn your entire annual TOTAL and WinTOTAL databases of signed or inspected reports into a customizable spreadsheet with mileage totals, fuel consumption, fuel expense, and even vehicle tax deduction estimates in just minutes. You’ll save time and not be stressed over your mileage documentation.

Results for making smarter business decisions

You need to make decisions based on your yearly vehicle expenses. Think: How much should you add to your minimum base fees to cover your average auto expense? How much would you save if you switch to a more fuel-efficient vehicle? Is it time to rethink your coverage areas, or at least your fees in outlying areas?

With Mileage Estimator, you’ll get a report that answers all your questions and gives you the information you need to make immediate, profit-boosting decisions.

Your tax pro will thank you

The best way to use Mileage Estimator is as a management tool to help you run your business. However, the spreadsheet is incredibly valuable for your tax professional too. Just in case you don’t have perfect receipts (like most people), your report provides a reasonable basis for using estimated drive times and potentially significant deductions.

Mileage Estimator is like a “customary and reasonable” measuring stick for vehicle mileage. You drove to those subjects and comps, and Mileage Estimator calculates how much mileage it would have contributed to your car. When the report is generated, you retain complete control over the mileage estimates on a report-by- report basis, and can edit, add to, or subtract from the report as you see fit.

Once you’ve verified everything and made your tweaks, simply send it to your tax preparer and let them decide the best options for you. They’ll be thankful, and amazed at the detail.

Reduce the likelihood of mistakes and see how much your drive time really costs

It’s simple to do. Just point to your report folders and export the data.

| Here’s how it works: | |

|---|---|

| Maps the distance from your office to the subject property and all comps for each report | |

| Includes links to the driving directions used | |

| Calculates fuel and standard deductions using geocoding | |

| Option to include comps from the Workfile that didn’t make it into the final report | |

| Full-year or specific date range reporting options | |

| Creates appraiser-specific reports – great for multi-appraiser offices | |

| Everything gets added to one customizable, easy-to- read Excel spreadsheet | |

| Detect changes in expenses year-over- year or for specific date ranges by comparing Mileage | |

| Estimator reports |

Do yourself a favor and get Mileage Estimator 2024 for just $69!

As always, your purchase is backed by our 100-day, 100% money back guarantee.